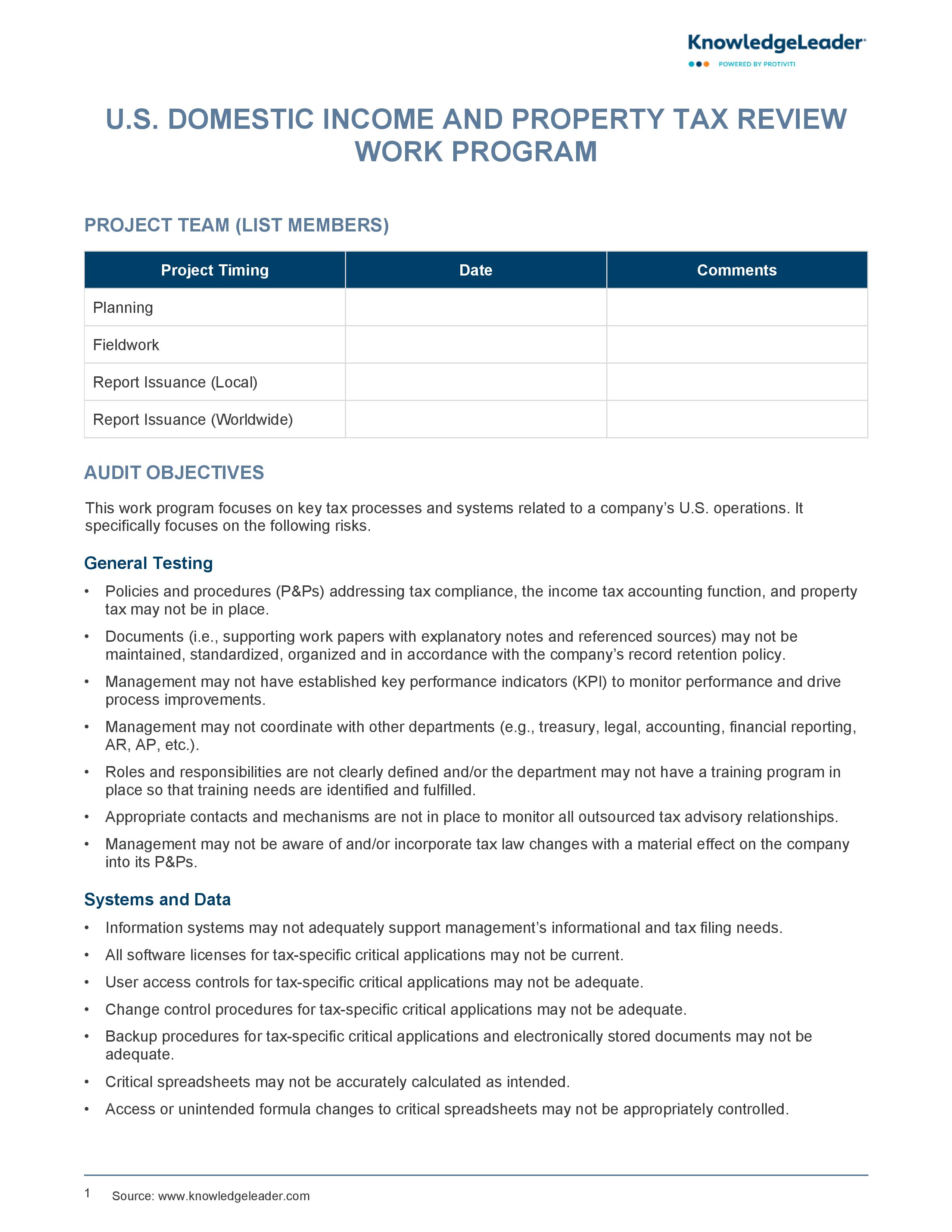

U.S. Domestic Income and Property Tax Review Audit Work Program

A Comprehensive Analysis of U.S. Domestic Income and Property Tax Practices

This work program reviews key tax processes and systems related to a company’s U.S. operations. The document is designed to identify and mitigate risks associated with income and property tax compliance, accounting functions and the use of information systems. It outlines detailed audit objectives and procedures, including the evaluation of policies and procedures, user access controls, change management processes, and the accuracy of critical spreadsheets. It provides step-by-step instructions for testing various aspects of tax compliance, such as preparing and filing tax returns, approving tax payments, and ensuring timely payment of estimated taxes.

Additionally, it emphasizes the importance of maintaining standardized and organized documentation, establishing key performance indicators, and coordinating with other departments. It addresses the need to monitor outsourced tax advisory relationships and stay updated on tax law changes. By following this structured audit work program, companies can ensure that their tax-related processes are efficient, compliant and accurately documented, ultimately reducing the risk of non-compliance and financial discrepancies.

Sample audit risks include:

- Policies and procedures addressing tax compliance, the income tax accounting function, and property tax may not be in place.

- Documents may not be maintained, standardized, organized, or in accordance with the company’s record retention policy.

- Management may not have established key performance indicators (KPIs) to monitor performance and drive process improvements.

- Management may not coordinate with other departments (e.g., treasury, legal, accounting, financial reporting, AR, AP, etc.).