Tax Compliance Process Internal Control Questionnaire

Subscriber Content

Preview Image

Image

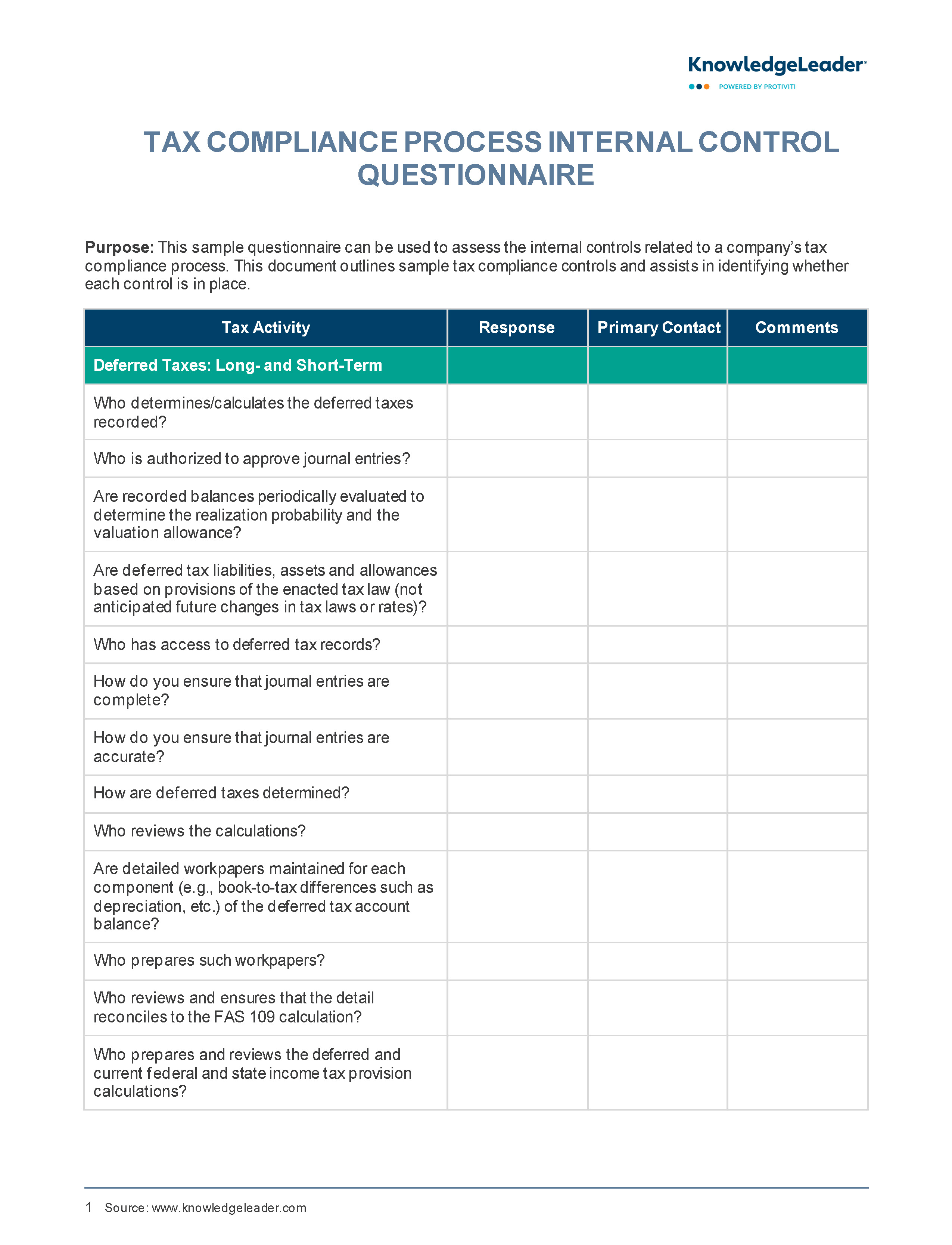

Evaluate the Internal Controls Connected to Your Tax Compliance Process

This sample questionnaire can be used to assess the internal controls related to a company’s tax compliance process. It outlines sample tax compliance controls and assists in identifying whether each control is in place.

Sample questions include: Who determines/calculates the deferred taxes recorded? Who is authorized to approve journal entries? Are recorded balances periodically evaluated to determine the realization probability and the valuation allowance? Who has access to deferred tax records? How do you ensure that journal entries are complete? How do you ensure that journal entries are accurate? How are deferred taxes determined? Who reviews the calculations?

Related Resources