Health Reimbursement Accounts Audit Work Program

Audit Procedures for Health Reimbursement Accounts

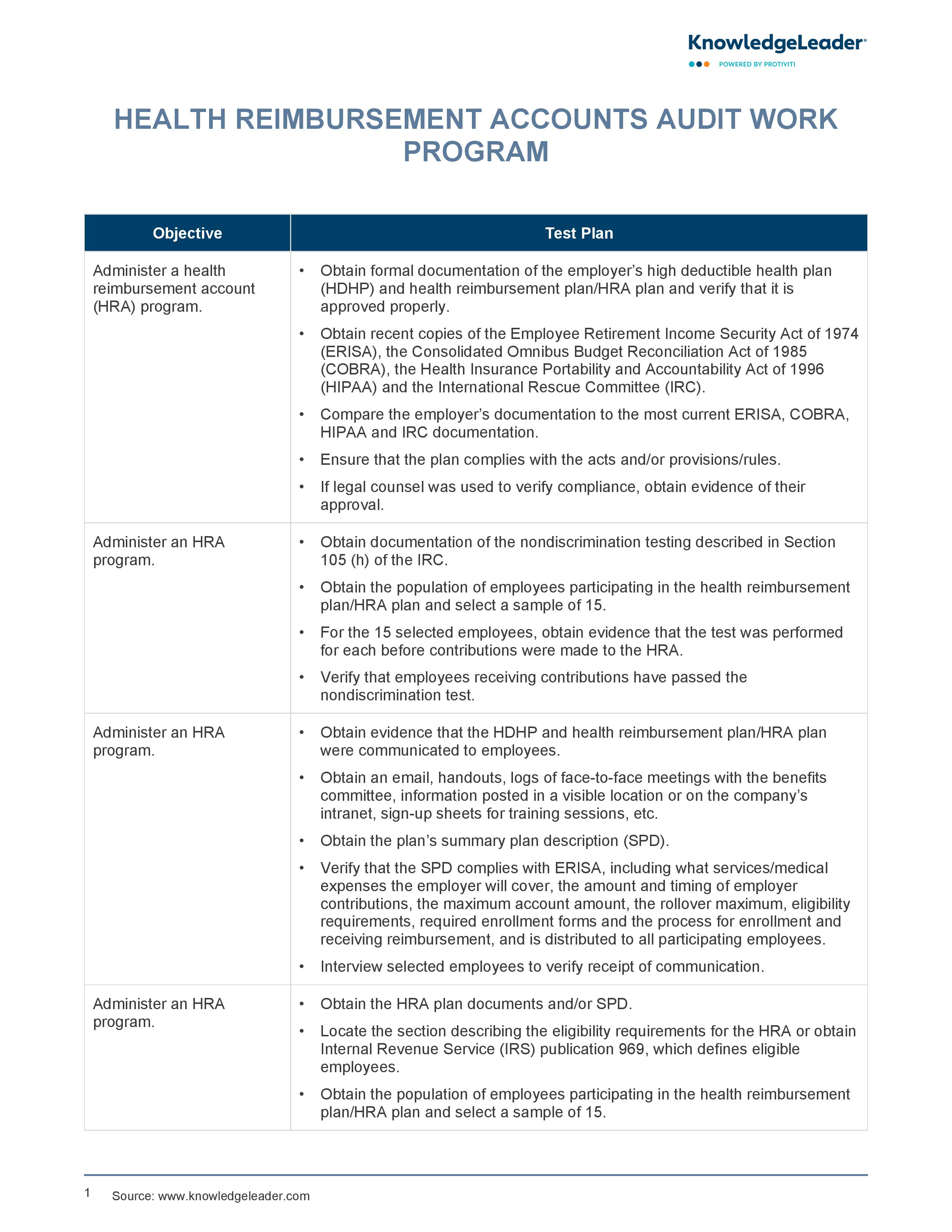

Ensure the proper administration and compliance of Health Reimbursement Accounts (HRAs) within your organization with this audit program sample, which outlines detailed audit objectives and test plans to verify that the employer's HRA program aligns with regulatory requirements such as ERISA, COBRA, HIPAA and IRC. The document includes procedures for obtaining and reviewing formal documentation of the employer's high deductible health plan (HDHP) and HRA plan.

Additionally, it provides steps to verify proper communication of the HRA plan to employees, accurate account reconciliations and appropriate access controls within the payroll module. This audit work program also emphasizes the importance of annual evaluations by the board of directors or benefits committee to ensure that the HRA program remains compliant and effective.

Sample auditing steps include:

- Obtain formal documentation of the employer’s high deductible health plan (HDHP) and health reimbursement plan/HRA plan.

- Compare the employer’s documentation to the most current ERISA, COBRA, HIPAA and IRC documentation.

- Ensure that the plan complies with the acts and/or provisions/rules.

- If legal counsel was used to verify compliance, obtain evidence of their approval.