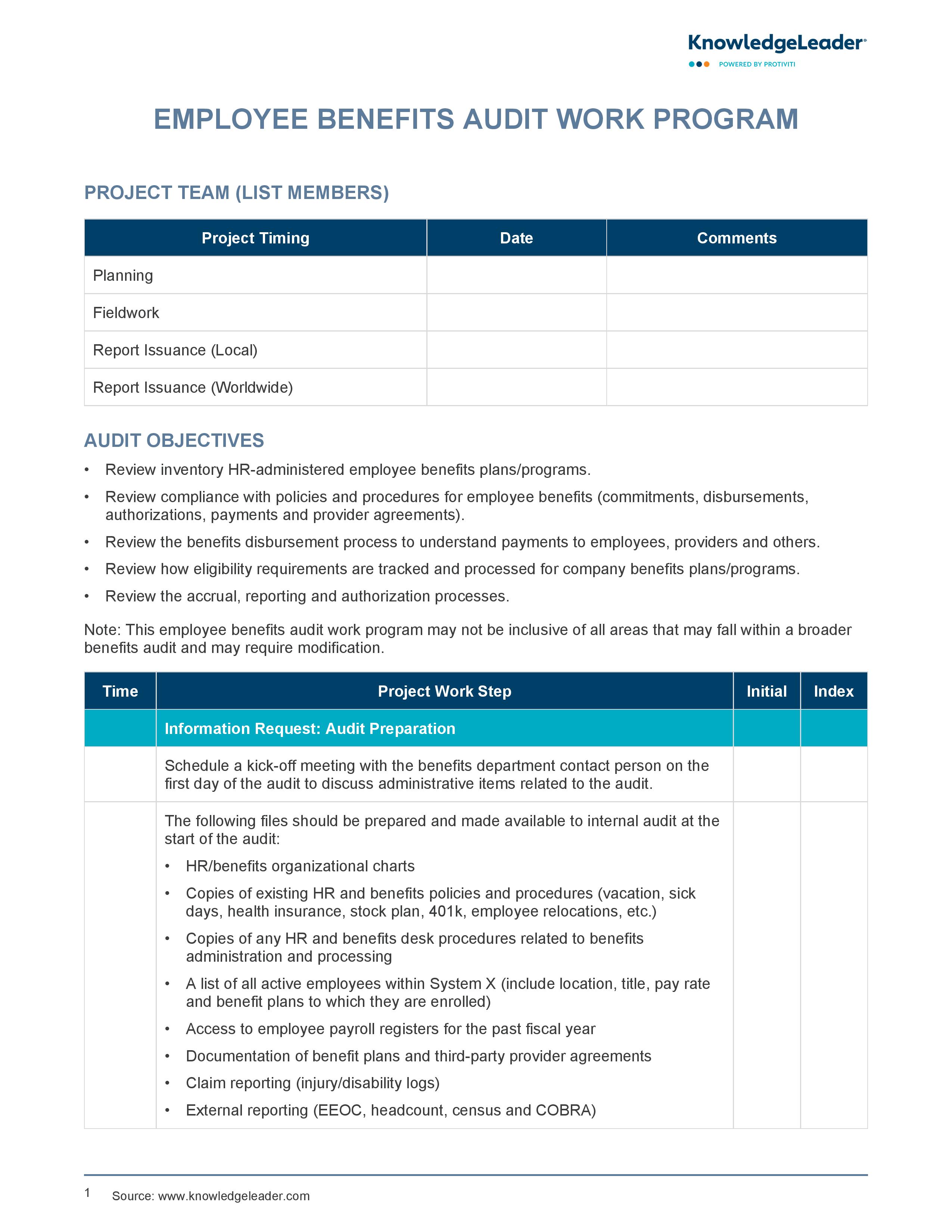

Employee Benefits Audit Work Program

A Comprehensive Review of Employee Benefits Programs

Our Employee Benefits Audit Work Program covers best-practice steps for conducting an audit on HR-administered employee benefits plans/programs. This tool provides a structured work program to review compliance with policies and procedures for employee benefits, including commitments, disbursements, authorizations, payments and provider agreements. The document also explains the process of reviewing the benefits disbursement process, eligibility requirements, accrual, reporting and authorization processes.

It includes steps to understand and verify the adequacy of period-end accruals, the authorization process for making changes to benefits plans, and the reconciliation of benefit deductions to amounts disbursed. The document further details how to evaluate the skills and qualifications of the benefits department staff and assess the legal department's involvement in the management of benefits plans. Lastly, it outlines how to prepare audit findings, develop recommendations, and draft an audit report. Therefore, this document is a valuable tool for achieving a thorough and systematic audit of employee benefits programs.

Audit objectives include reviewing:

- Inventory HR-administered employee benefits plans/programs

- Compliance with policies and procedures for employee benefits

- The benefits disbursement process to understand payments to employees, providers and others

- How eligibility requirements are tracked and processed for company benefits plans/programs