Investing in China: Unpacking the SEC’s Concerns

Government Regulations and the Effect of Changes

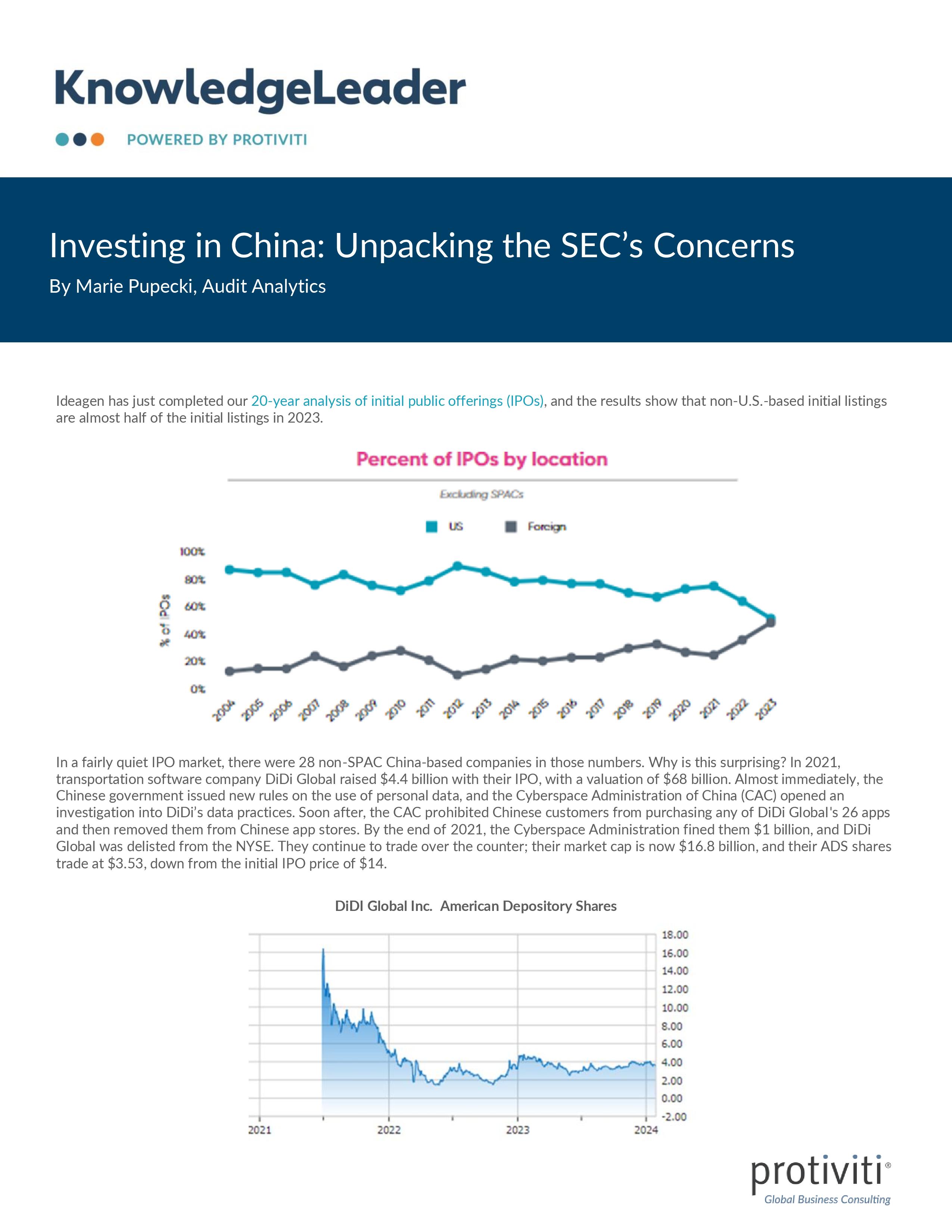

Audit Analytics has just completed its 20-year analysis of initial public offerings (IPOs), and the results show that non-U.S.-based initial listings were almost half of the initial listings in 2023. In a fairly quiet IPO market, there were 28 non-SPAC China-based companies in those numbers. Why is this surprising? In 2021, transportation software company DiDi Global raised $4.4 billion with their IPO, with a valuation of $68 billion. Almost immediately, the Chinese government issued new rules on the use of personal data, and the Cyberspace Administration of China (CAC) opened an investigation into DiDi’s data practices.

In this article, Audit Analytics examines the Securities and Exchange Commission’s highlights of critical risks to consider when investing in China.