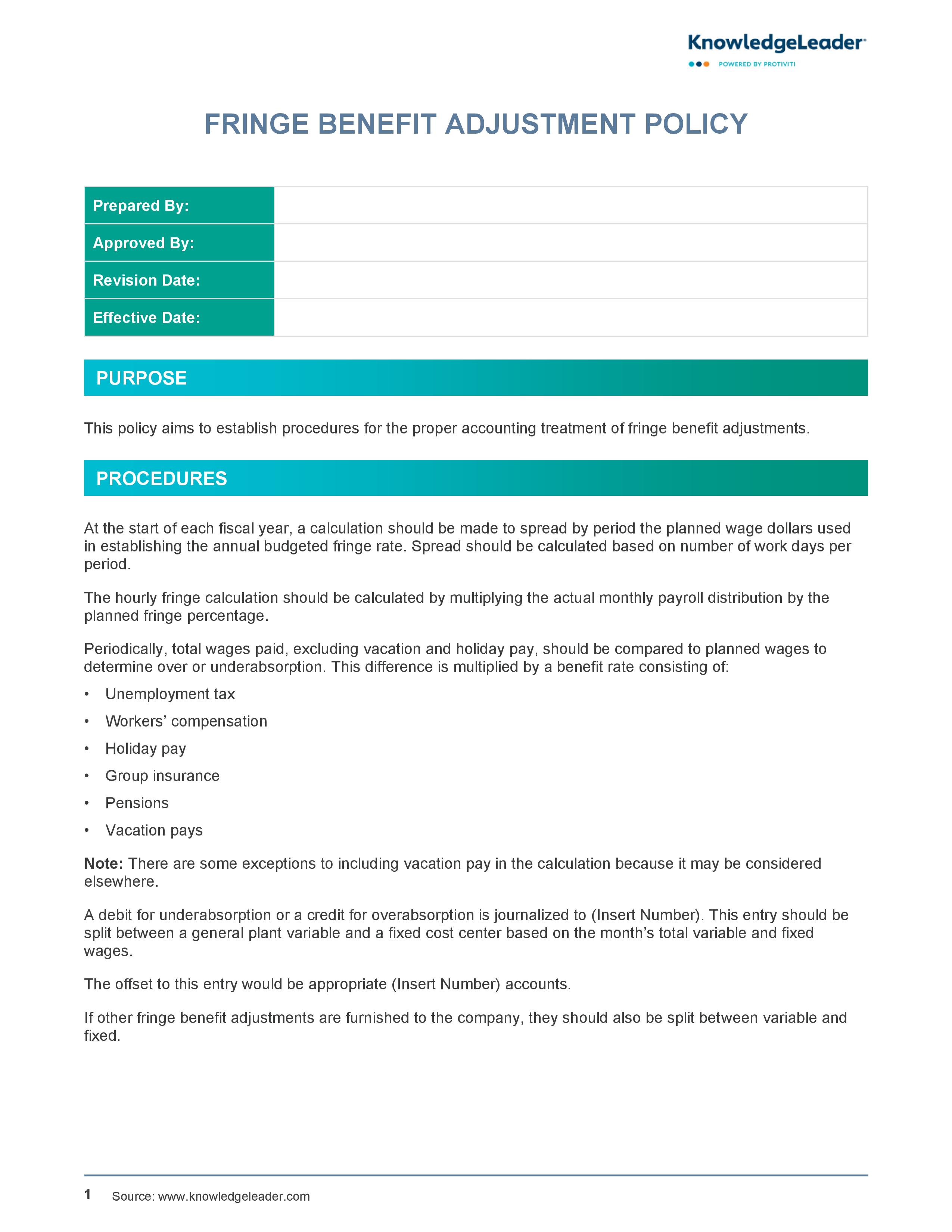

Fringe Benefit Adjustment Policy

Subscriber Content

Preview Image

Image

Guidelines for Managing Employee Benefit Adjustments

The procedures included in this sample policy can be used for the proper accounting treatment of fringe benefit adjustments.

According to this policy, at the start of each fiscal year, a calculation should be made to spread by period the planned wage dollars used in establishing the annual budgeted fringe rate; spread should be calculated based on the number of workdays per period; the hourly fringe calculation should be calculated by multiplying the actual monthly payroll distribution by the planned fringe percentage; and periodically, total wages paid, excluding vacation and holiday pay, should be compared to planned wages to determine over or underabsorption.

Related Resources