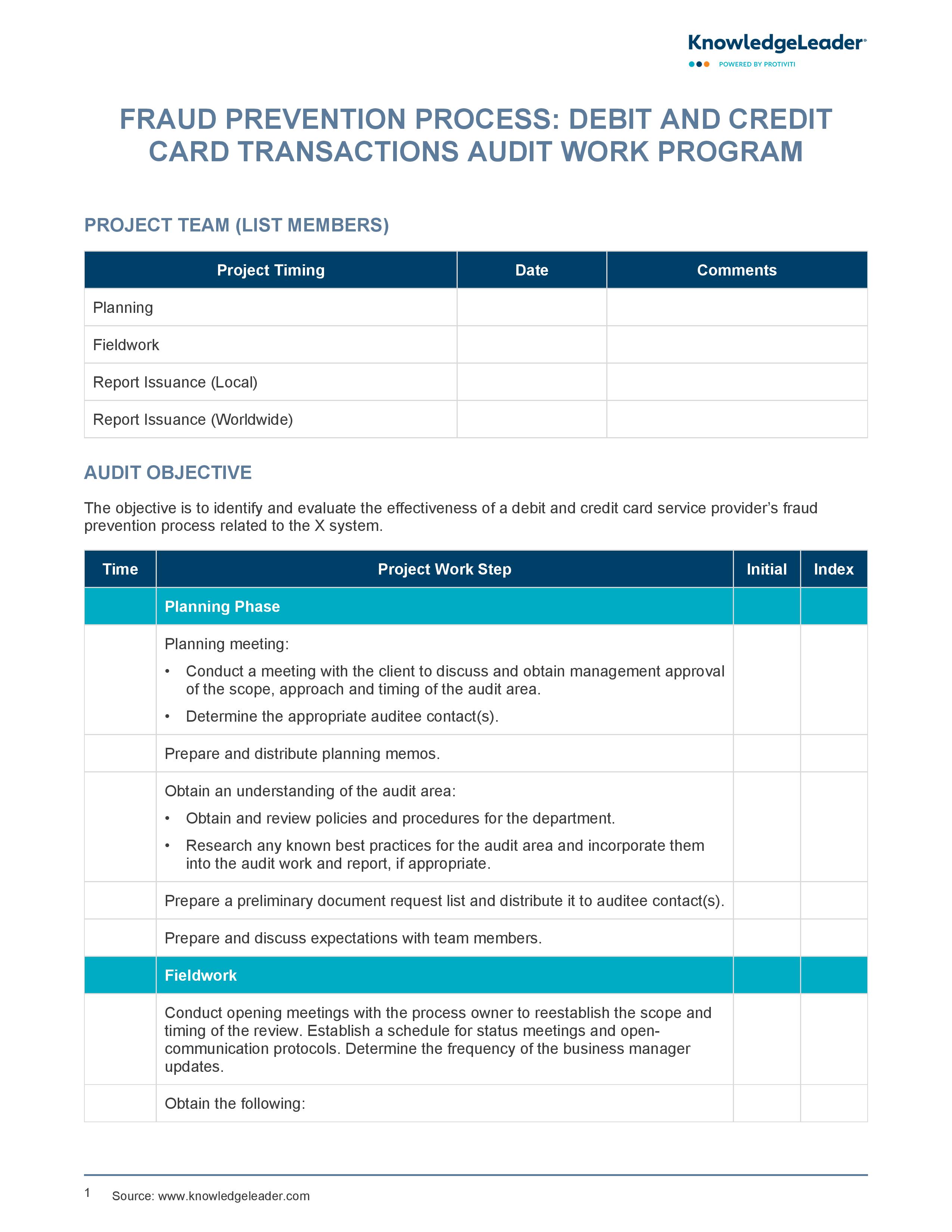

Fraud Prevention Process: Debit and Credit Card Transactions Audit Work Program

A Systematic Approach to Preventing Fraud in Debit and Credit Card Operations

Organizations can use this work program sample to evaluate the effectiveness of their debit and credit card service provider's fraud prevention process. It outlines the audit objectives, planning phase, fieldwork and report issuance stages, detailing specific tasks like conducting meetings, preparing memos and reviewing policies. The document emphasizes understanding the audit area and incorporating best practices. In the fieldwork stage, it can be used to observe and document the process for monitoring fraudulent activity, including system settings, flagging of transactions, client communication methods and review procedures.

It also covers how different types of transactions, like PIN and signature-based, are monitored. The document provides a guide for selecting a sample of client numbers for system setting evaluation, documenting work papers, validating findings with the process owner, and preparing draft and final reports. This comprehensive program thus equips you with the necessary tools to identify, evaluate and report on the efficiency and effectiveness of a company's fraud prevention process in debit and credit card transactions.

Best-practice audit steps include:

- Conduct a meeting with the client to discuss and obtain management approval of the scope, approach and timing of the audit area.

- Determine the appropriate auditee contact(s).

- Prepare and distribute planning memos.

- Obtain and review policies and procedures for the department.