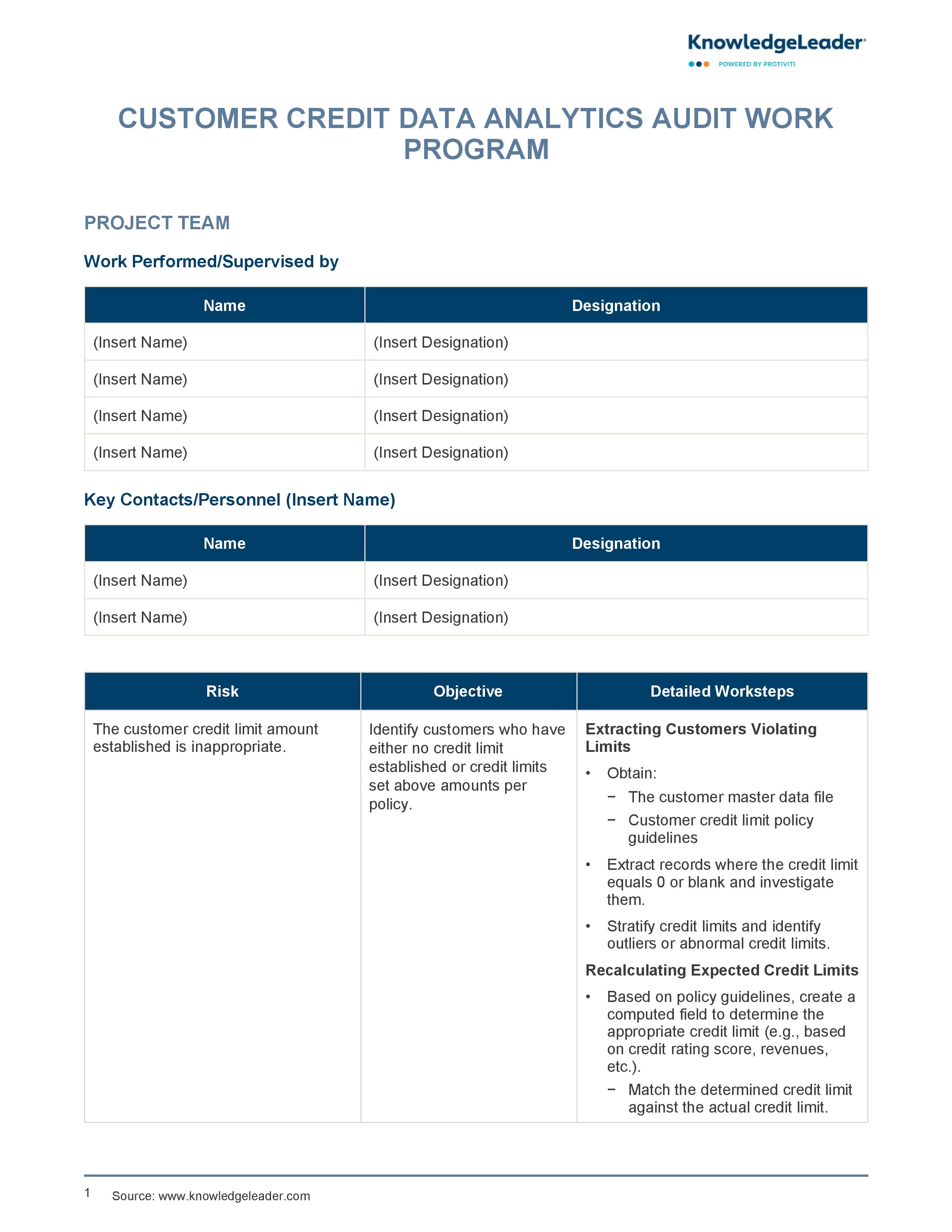

Customer Credit Data Analytics Audit Work Program

Subscriber Content

Preview Image

Image

An In-Depth Analysis of Customer Credit Data Handling

This seven-page work program utilizes data analytics to review steps in the customer credit process, including extracting customers who are violating limits, recalculating expected credit limits, extracting customer usage above credit, and identifying revenue reversals.

Audit objectives include:

- Identify customers who have either no credit limit established or credit limits set above amounts per policy

- Verify that customer credit limits are adhered to, matching customer invoices to credit limits

- Validate that revenue reversal entries are appropriate

- Evaluate past-due balances for collectability and potential adjustments

Related Resources