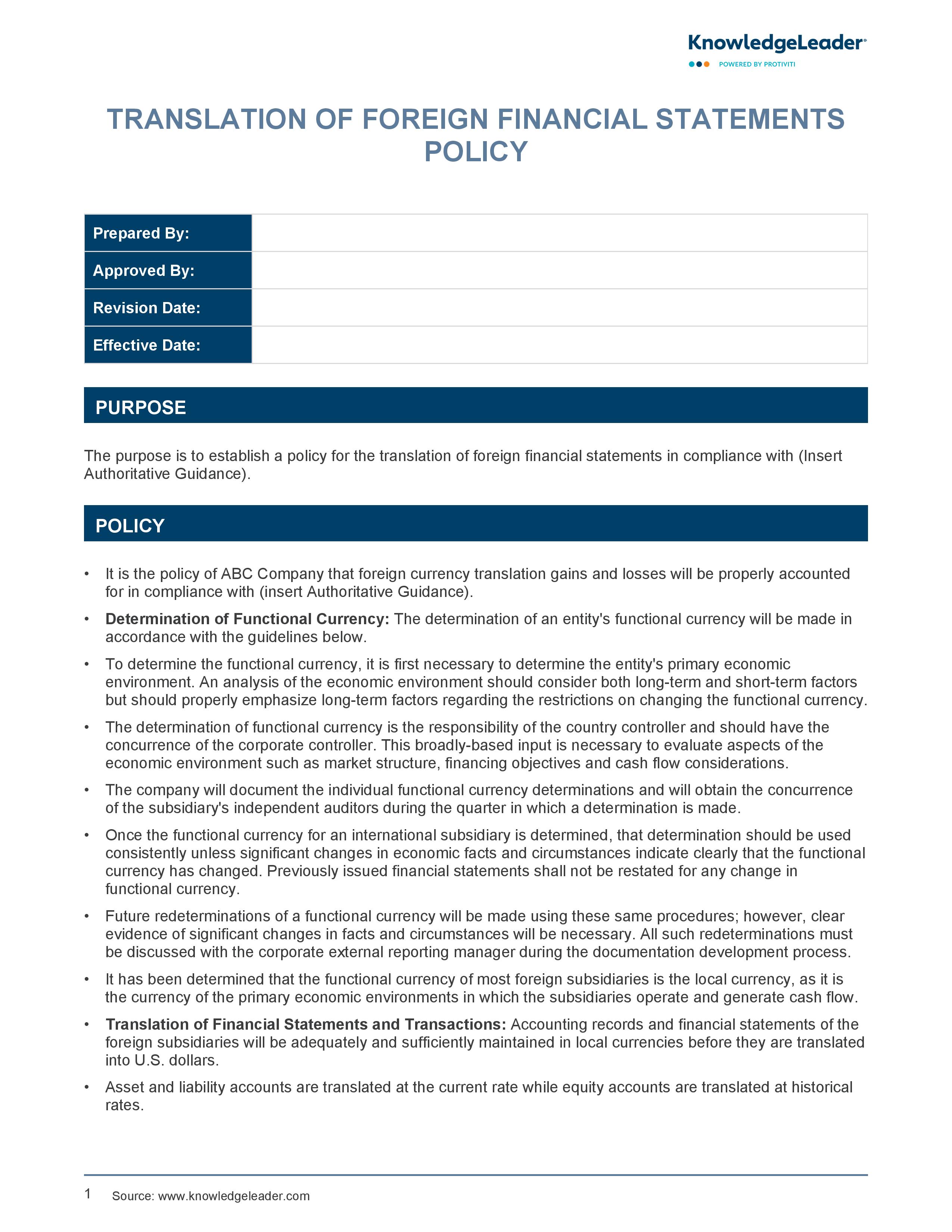

Translation of Foreign Financial Statements Policy

Standardizing the Translation of Foreign Financials With Best Practices

Our Translation of Foreign Financial Statements Policy is designed to ensure accurate and consistent translation of financial statements from foreign subsidiaries into U.S. dollars. This policy establishes the procedures for determining each entity's functional currency, emphasizing the importance of the primary economic environment. The policy mandates that accounting records and financial statements be maintained in local currencies before translation, with specific methods for translating assets, liabilities, revenues and expenses.

The policy also addresses the revaluation of inventory balances and the elimination of intercompany profits during consolidation. It provides detailed instructions for handling fixed and long-term assets, ensuring that transfers between subsidiaries are accurately reflected without realizing intercompany profits. Additionally, the document stipulates that any principles not explicitly covered must be reviewed and approved by the corporate controller.

Sample procedures include:

- Revenues and expenses are translated at the month-end rate, which is an approximation of the average rate.

- The materiality of the effect of using the month-end rate rather than the average rate should be evaluated.

- Translation gains and losses (adjustments) are not included in net income but rather are included in an equity account on the financial statements.

- Foreign subsidiaries maintain their assets and liabilities in local currencies and revalue them into U.S. dollars monthly.