Subsequent Events Policy

Guiding Responses to Subsequent Events

Establish a structured process for assessing and handling events that occur after the balance sheet date but prior to the issuance of financial statements.

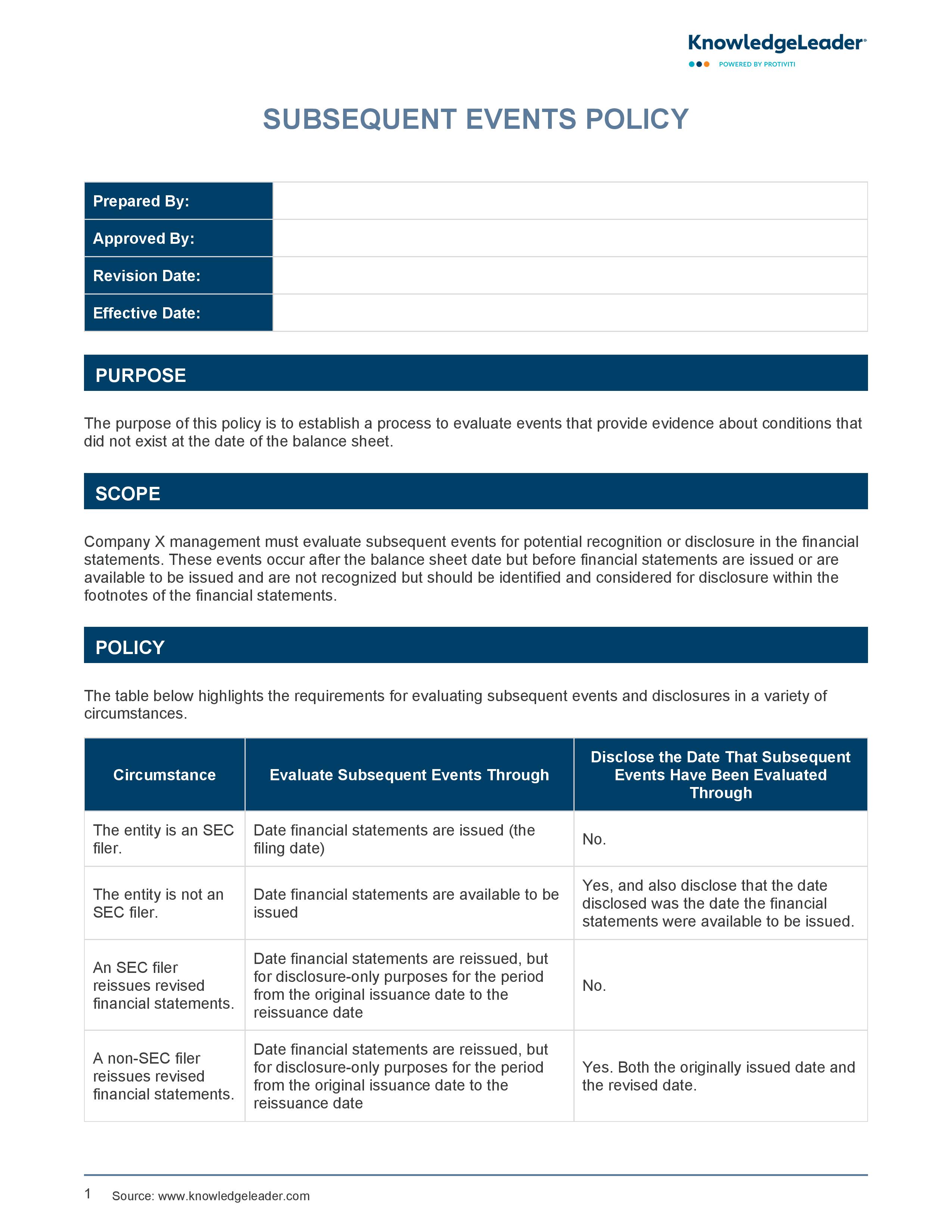

The primary purpose of this sample policy is to identify and evaluate conditions not present at the time the balance sheet was prepared, ensuring that significant events are either recognized or adequately disclosed within the footnotes of financial statements. This policy delineates clear requirements for different circumstances, such as whether an entity is an SEC filer or not, and provides directives on how to evaluate subsequent events.

For SEC filers and non-SEC filers, it specifies whether to disclose the date through which subsequent events have been evaluated depending on if financial statements are issued or available to be issued. Additionally, for both reissued revised financial statements and original issuances, it outlines disclosure obligations. Overall, this policy ensures transparency and compliance in financial reporting by providing guidelines on how post-balance sheet events should be factored into financial documentation.

For such events, the company should disclose the following:

- The nature of the event

- An estimate of its financial effect or a statement that such an estimate cannot be made