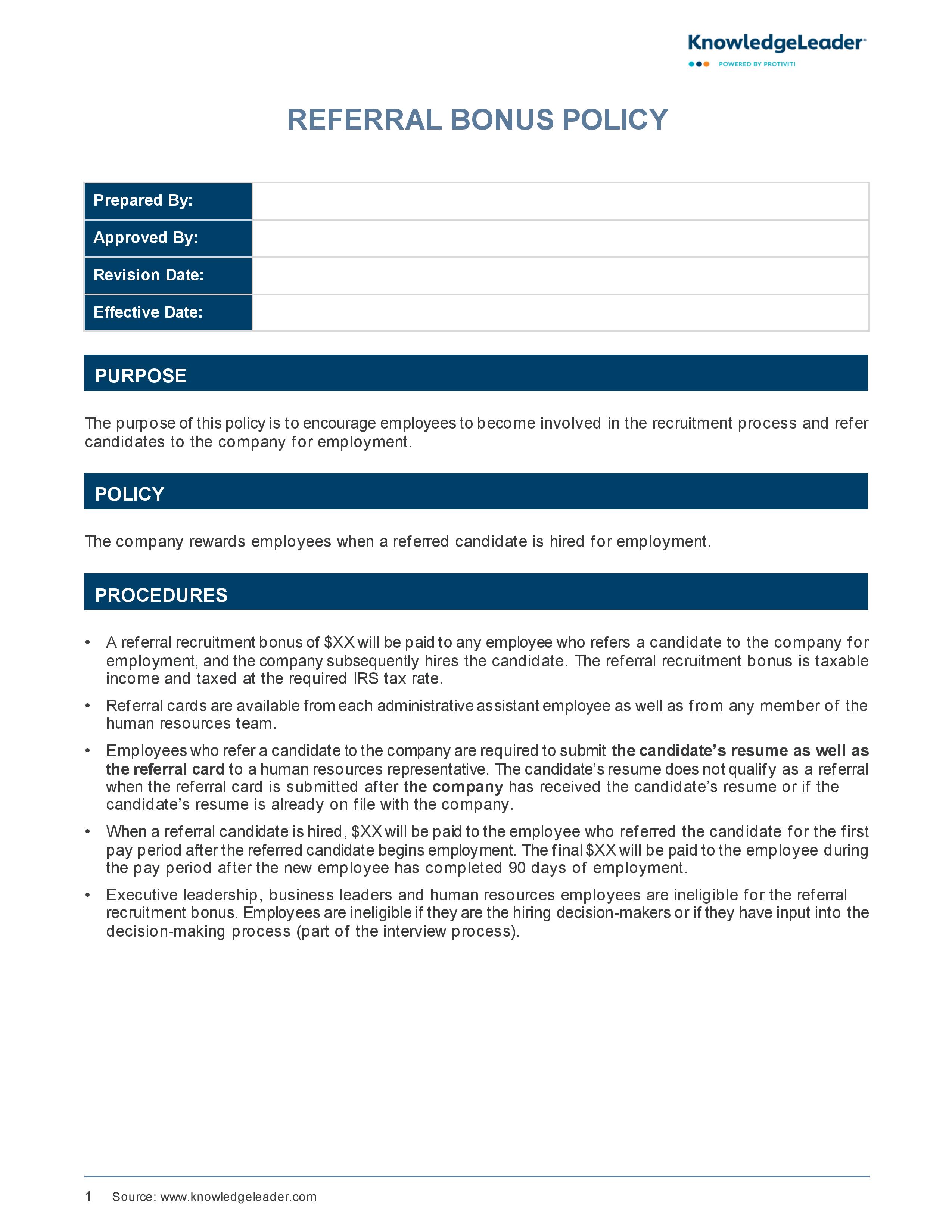

Referral Bonus Policy

Subscriber Content

Preview Image

Image

Structuring Reward Programs for Employee Referrals

The following sample outlines a set of policies and procedures for referral bonuses to encourage employees to become involved in the recruitment process and refer candidates to the company for employment.

This sample policy states that a referral recruitment bonus amount should be paid to any employee who refers a candidate to the company for employment and the candidate is subsequently hired by the company. Referral recruitment bonuses are taxable income and should be taxed at the required IRS tax rate. In addition, this policy outlines the roles and responsibilities of the referring employee and human resources and provides a list of employees who are ineligible for the referral recruitment bonus.