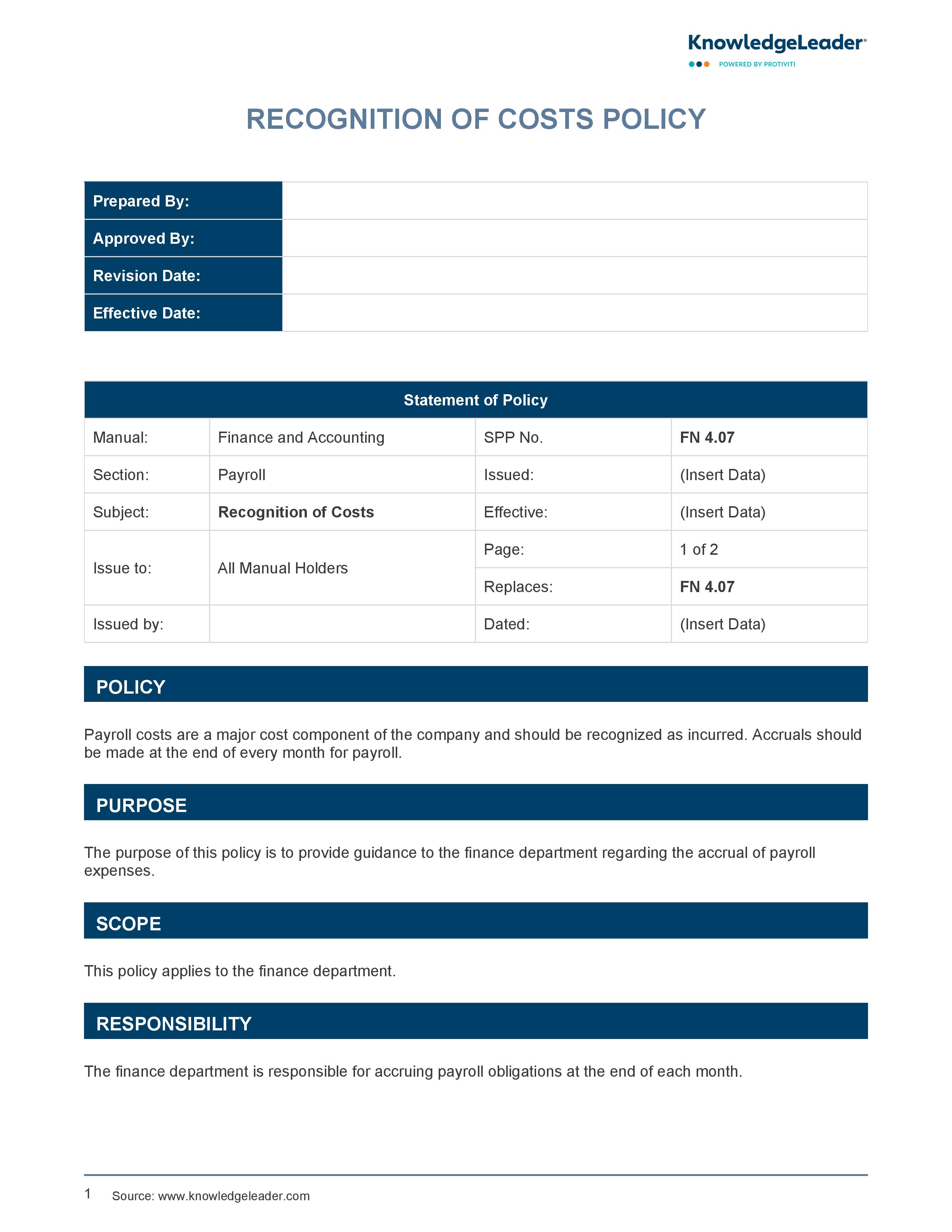

Recognition of Costs Policy

Subscriber Content

Preview Image

Image

Procedures for Recognizing and Reporting Costs Accurately

Access our recognition of costs policy to ensure accurate reporting and recognition of payroll costs, including salaries and benefits.

According to this policy, payroll costs consist of salaries, wages, overtime, employee benefits and pension contributions made by the company, as well as the employer portion of statutory deductions such as employment insurance. In this policy, payroll costs are a major cost component of the company and should be recognized as incurred. Accruals should be made at every month-end for payroll. The finance department is responsible for accruing payroll obligations at the end of each month.

Related Resources

Cost Accounting CPE Courses