Leases Policy

Subscriber Content

Preview Image

Image

Procedures for Maintaining and Accounting for Leases

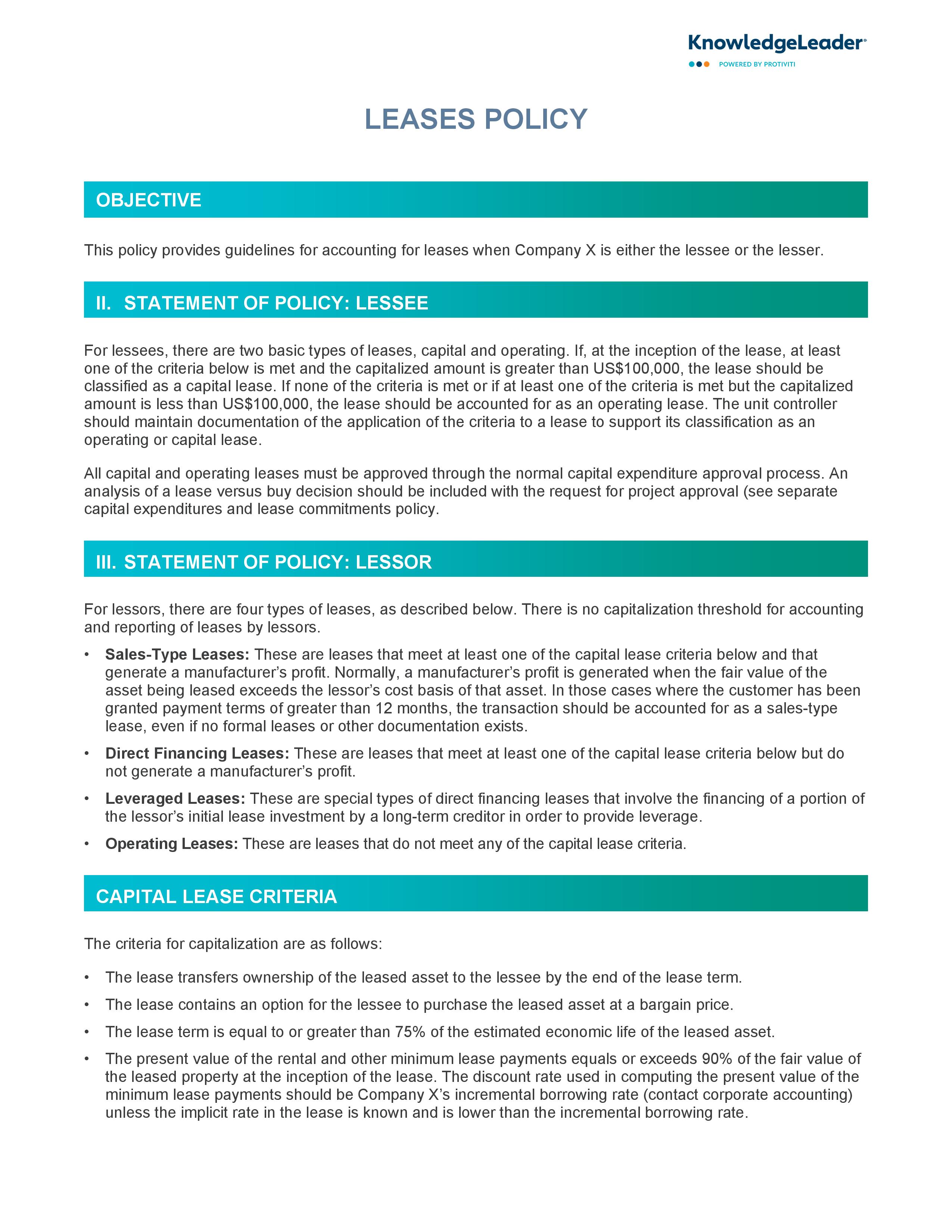

This sample leases policy provides guidelines for accounting for leases when a company is either the lessee or the lesser.

In this sample, for operating leases, initial assets or obligations are not recorded, and the lessee generally records the rental payments on the lease as rent expenses over the lease term. However, if the lease contains any rent holidays, reduced rent incentives or fixed escalating payments, the annual rent expense recorded should equal the total gross lease payments under the lease divided by the lease term. Any rent expense recorded over the rent payments made should be recorded in accrued liabilities as deferred rent.

Related Resources