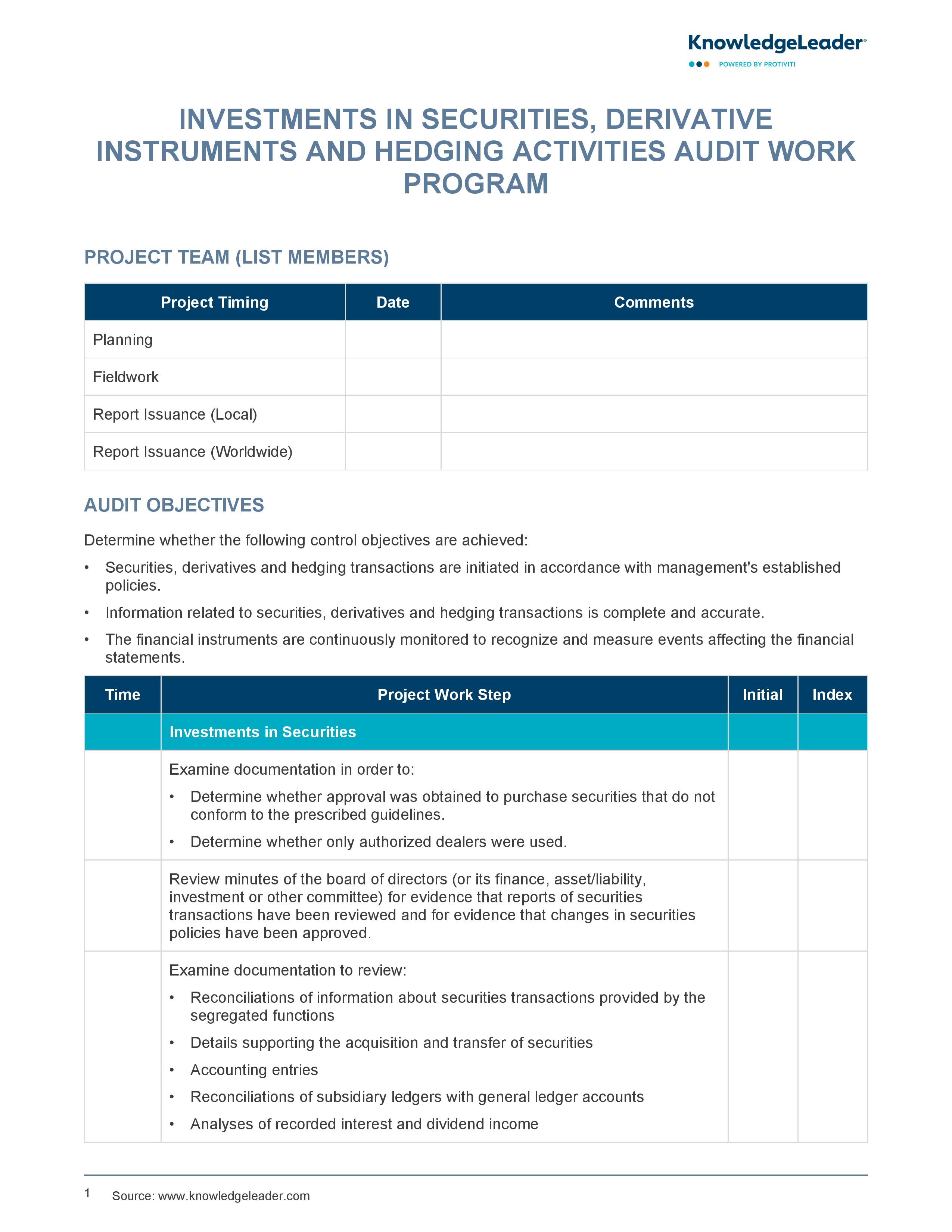

Investments in Securities, Derivative Instruments and Hedging Activities Audit Work Program

A Sample Work Program to Audit Your Company’s Investment Procedures

The objective of this audit program is to review the controls related to a company’s investment procedures. This sample outlines a structured approach for assessing whether transactions are conducted in accordance with established management policies, ensuring that the information related to these transactions is both complete and accurate. It emphasizes the importance of monitoring financial instruments continuously to identify and measure any events that may impact the financial statements.

It includes detailed steps for examining documentation, such as approvals for purchasing securities, reviewing board minutes for transaction oversight, and ensuring that only authorized dealers are utilized. Additionally, it highlights the need for testing computer controls and reviewing reconciliations to confirm the integrity of recorded transactions. By providing a clear set of objectives and methodologies, this audit work program facilitates the evaluation of compliance and risk management practices within organizations.

According to this work program, documentation must be examined to review the following:

- Details of derivatives transactions to determine whether only authorized brokers and counterparties were used

- Reconciliations of information about derivatives transactions provided by the segregated functions

- Accounting entries

- Reconciliations of subsidiary ledgers with general ledger accounts