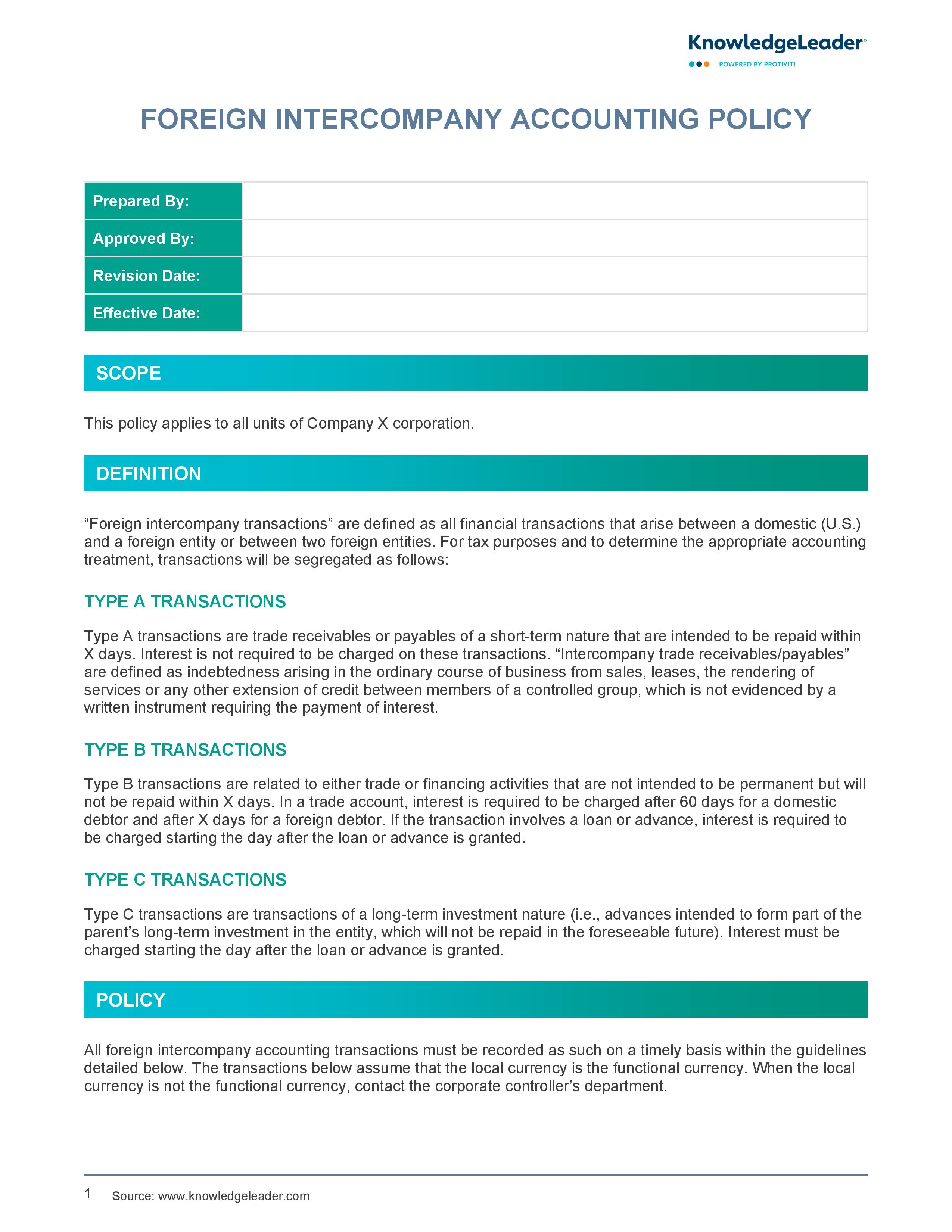

Foreign Intercompany Accounting Policy

Subscriber Content

Preview Image

Image

Procedures for Streamlining Cross-Border Financial Transactions

This policy outlines guidelines for financial transactions that arise between a domestic (U.S.) and a foreign entity or between two foreign entities.

In this sample, intercompany profits in inventory must be identified at least quarterly. The appropriate calculations should be made and communicated to the corporate consolidation department for recording. For management reporting purposes, intercompany profit eliminations will be applied at the appropriate level (e.g., division, group, business or interbusiness) and as such will affect consolidated profits at that level. The corporate controller is responsible for the establishment and interpretation of accounting policies pertaining to intercompany transactions.

Related Resources