Expense Recognition Policy

Subscriber Content

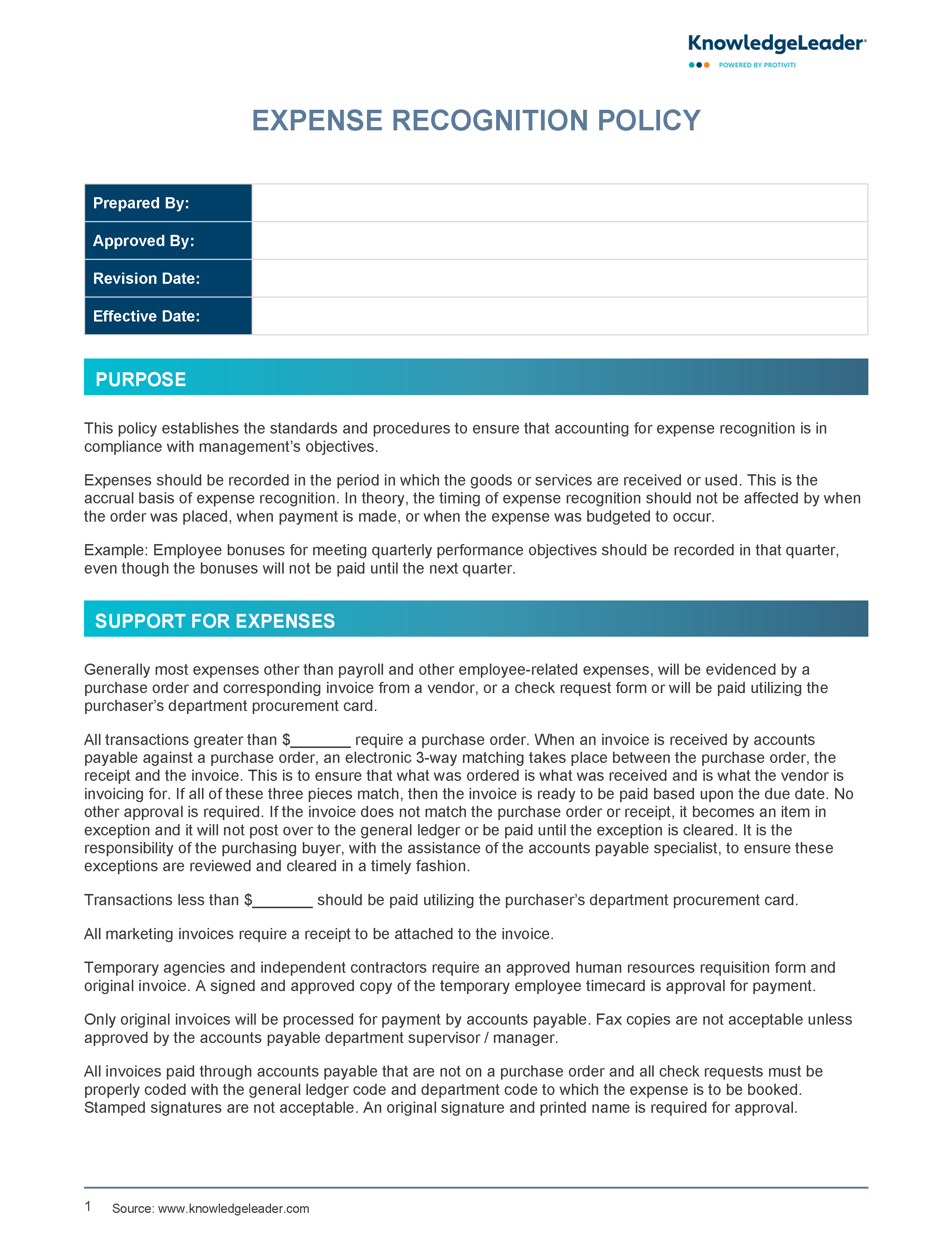

Preview Image

Image

Procedures for Effectively Managing Expense Recognition

This policy outlines a set of procedures for expense recognition. It establishes standards to ensure that accounting for expense recognition is in compliance with management's objectives.

According to this sample, expenses should be recorded in the period in which the goods or services are received or used. This is the accrual basis of expense recognition. In theory, the timing of expense recognition should not be affected by when the order was placed, when payment is made, or when the expense was budgeted to occur. For example: Employee bonuses for meeting quarterly performance objectives should be recorded in that quarter, even though the bonuses will not be paid until the next quarter.

Related Resources