Domestic Intercompany Accounting Policy

Subscriber Content

Preview Image

Image

Balancing Books at Home: Detailed Domestic Intercompany Accounting Practices

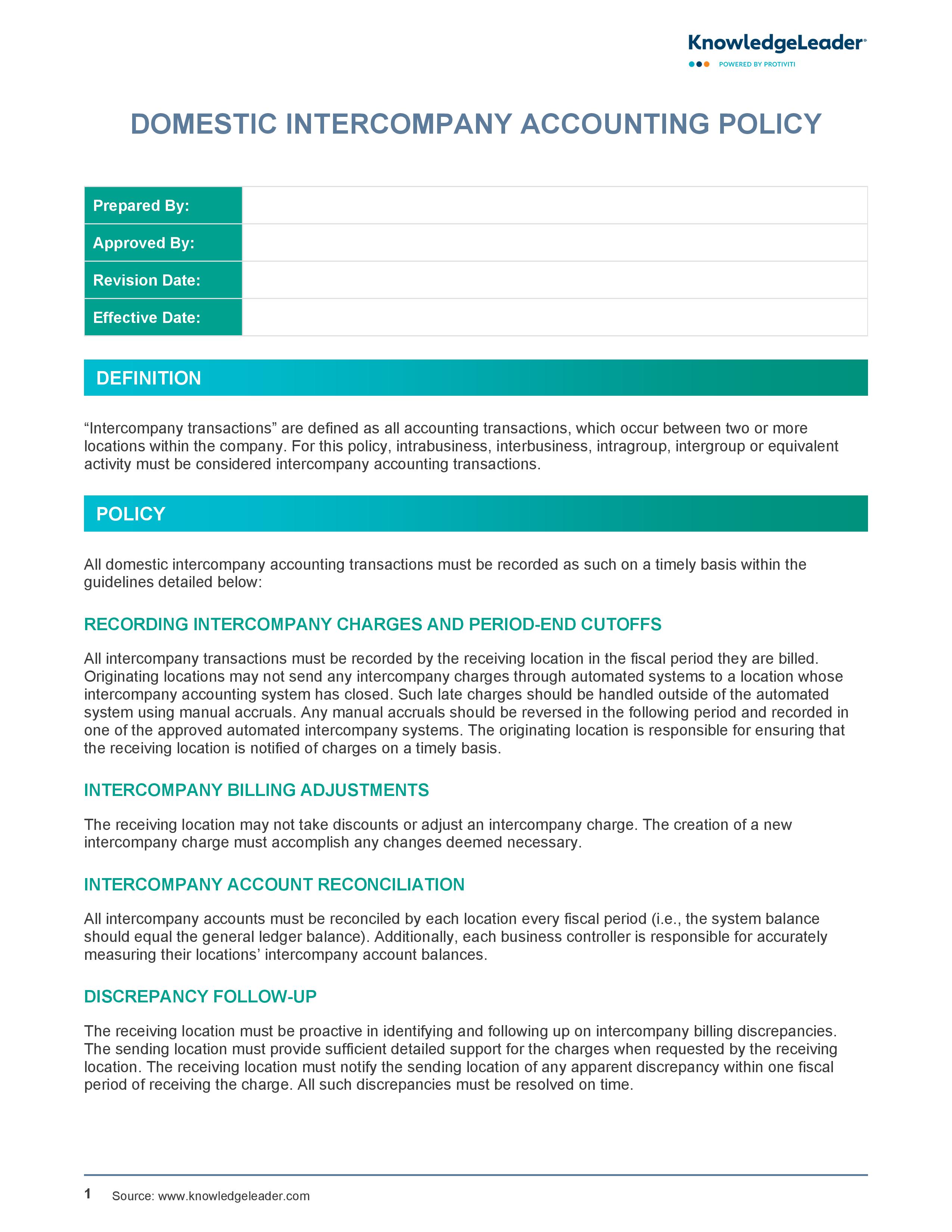

This policy establishes guidelines for recording intercompany accounting transactions, which are defined as all accounting transactions that occur between two or more locations within a company.

In this sample, all domestic intercompany accounting transactions must be recorded on a timely basis, focusing on the following transactions: recording intercompany charges and period-end cutoffs, intercompany billing adjustments, intercompany account reconciliation, discrepancy follow-up, shipments, approved intercompany systems, accruals, minimum intercompany transaction amounts, and documentation.

Related Resources

Checklists & Questionnaires