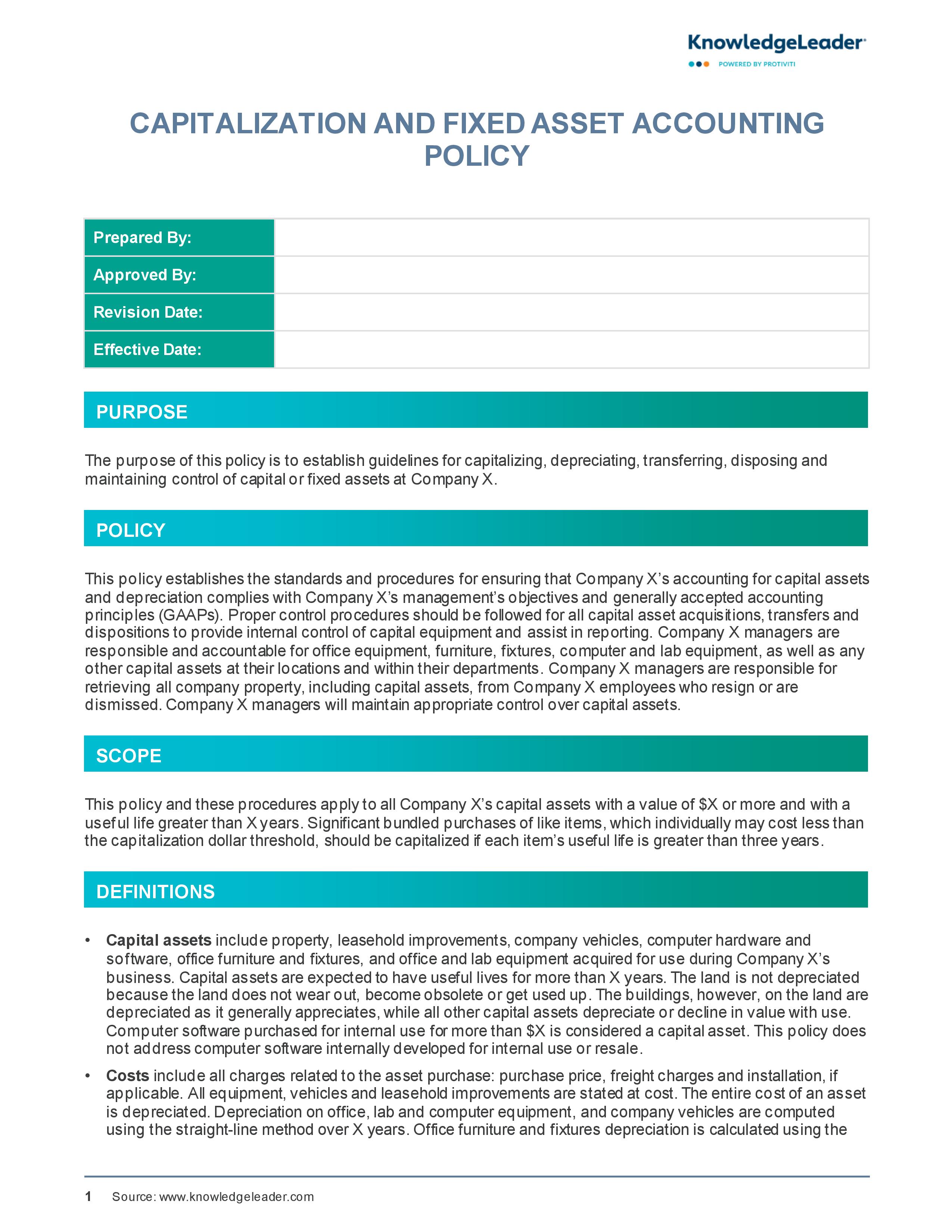

Capitalization and Fixed Asset Accounting Policy

Subscriber Content

Preview Image

Image

Guidelines on Capitalization and Fixed Asset Record Keeping

This policy establishes guidelines for capitalizing, depreciating, transferring, disposing and maintaining the control of capital or fixed assets at a company.

In this sample, we outline standards and procedures for ensuring that a company’s accounting for capital assets and depreciation follow management’s objectives and generally accepted accounting principles (GAAP). Proper control procedures will be followed for all capital asset acquisitions, transfers and dispositions in order to provide internal control of capital equipment and to assist in reporting. Managers are responsible for office equipment, furniture, fixtures, computer and lab equipment, and other capital assets.

Related Resources