Bank Expenditure Non-Payroll Cycle: Control Objectives and Audit Work Program

Preview Image

Image

Scrutinizing Control Objectives in Bank Expenditure Non-Payroll Cycles

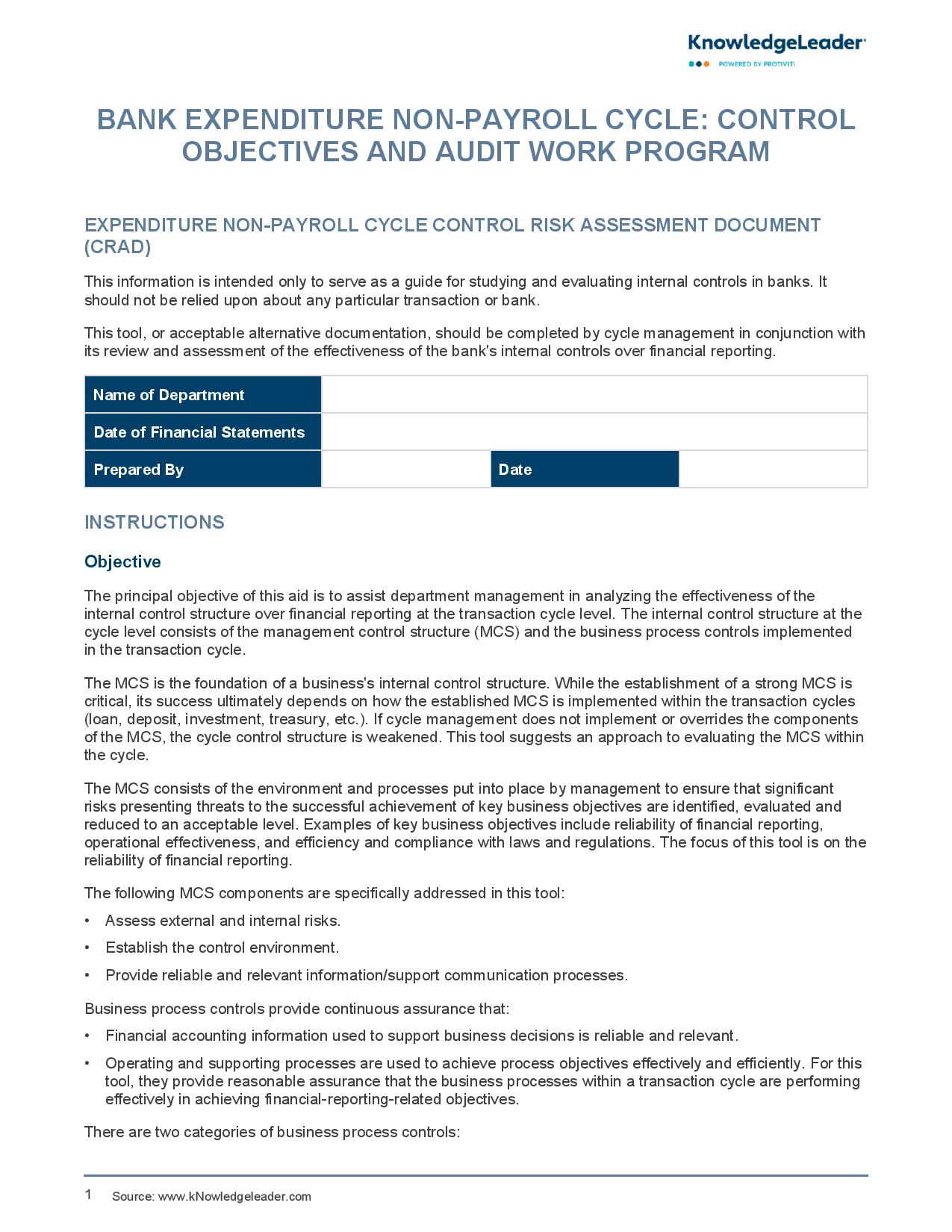

This Bank Expenditure Non-Payroll Cycle - Control Objectives and Audit Work Program serves as a guide to best practices for managing and auditing non-payroll bank expenditures. It includes various control objectives aimed at detecting errors, preventing fraud, ensuring accountability and improving financial accuracy. These controls can be applied to various processes, including accounts payable, cash disbursements, asset tracking and balance evaluation.

With its structured approach, this tool offers insights into safeguarding assets, substantiating balances accurately, and enhancing overall auditing practices in the non-payroll expenditure cycle.

Sample audit steps covered in this document include:

- Identify written procedures regarding purchasing functions activities.

- Require dual signatures for disbursements exceeding a certain dollar amount.

- Have adequate procedures to ensure accurate recording of orders placed with vendors, prices, quantities and terms for use in subsequent processing.

- Identify written policy statements with respect to the types of adjustments allowed and the authorization required.

Related Resources