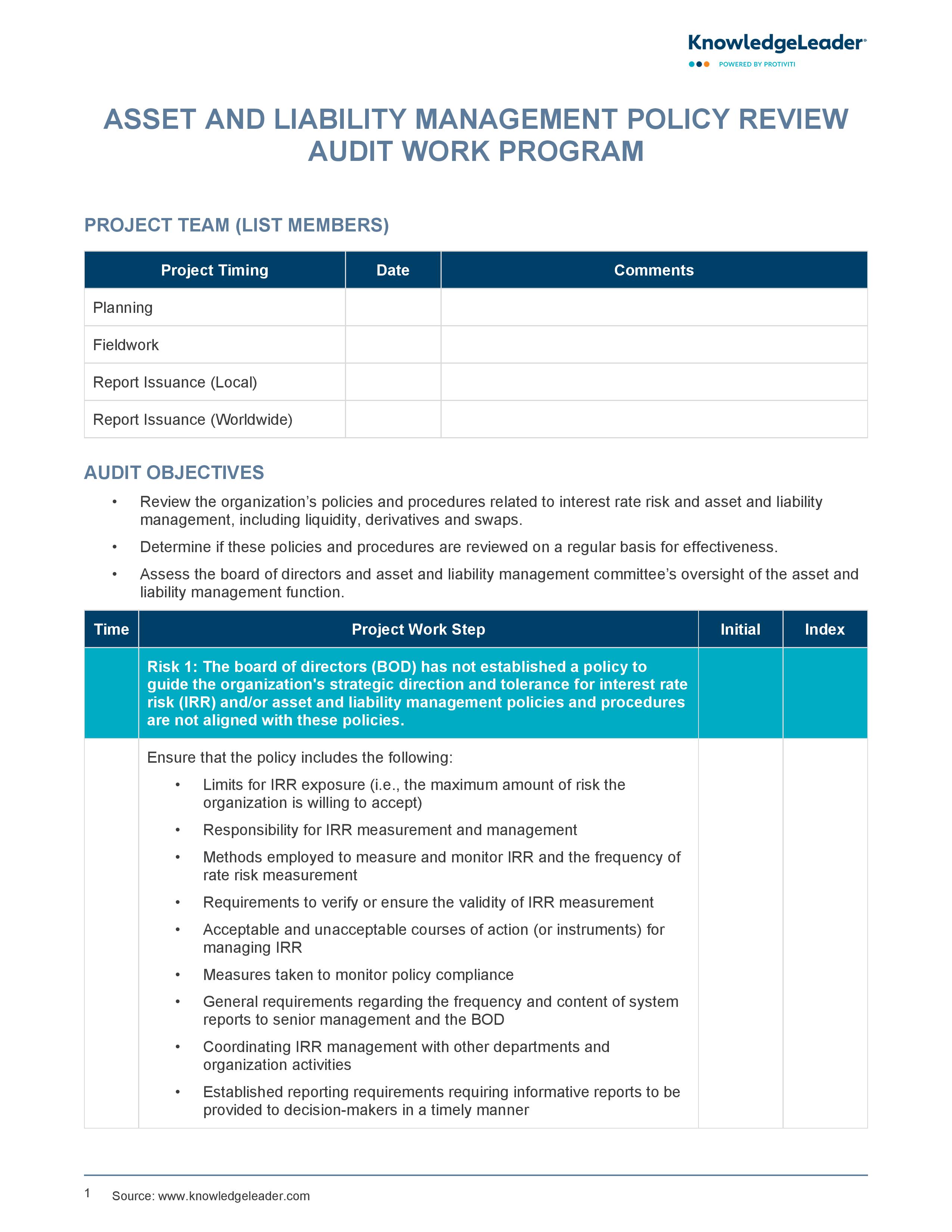

Asset and Liability Management Policy Review Audit Work Program

A Sample Work Program to Audit the Asset and Liability Management Process

Evaluate your organization's asset and liability management policies, procedures and risk oversight with the best-practice steps in this work program. This includes reviewing the organization's approach to interest rate risk, liquidity management, derivatives and swaps. The document provides a structured work program with specific steps to assess the board of directors and asset and liability management committee oversight, the adequacy of policies and procedures, their alignment with strategic direction, and their regular review for effectiveness.

This document also aids in identifying potential risks, such as inadequate oversight or outdated policies, and offers methods to verify compliance, understand key assumptions driving risk measurement reports, and evaluate the adequacy of review procedures. Ultimately, this document is instrumental for ensuring that an organization's asset and liability management aligns with best practices and regulatory requirements.

Policies and procedures to manage liquidity should include:

- Establishing responsibility and accountability for liquidity management and clearly delineating responsibility

- Specifying desired limits and positions

- Demonstrating an understanding of liquidity risk and defining the financial institution’s approach to managing liquidity

- Following management's strategic direction and established risk tolerance levels