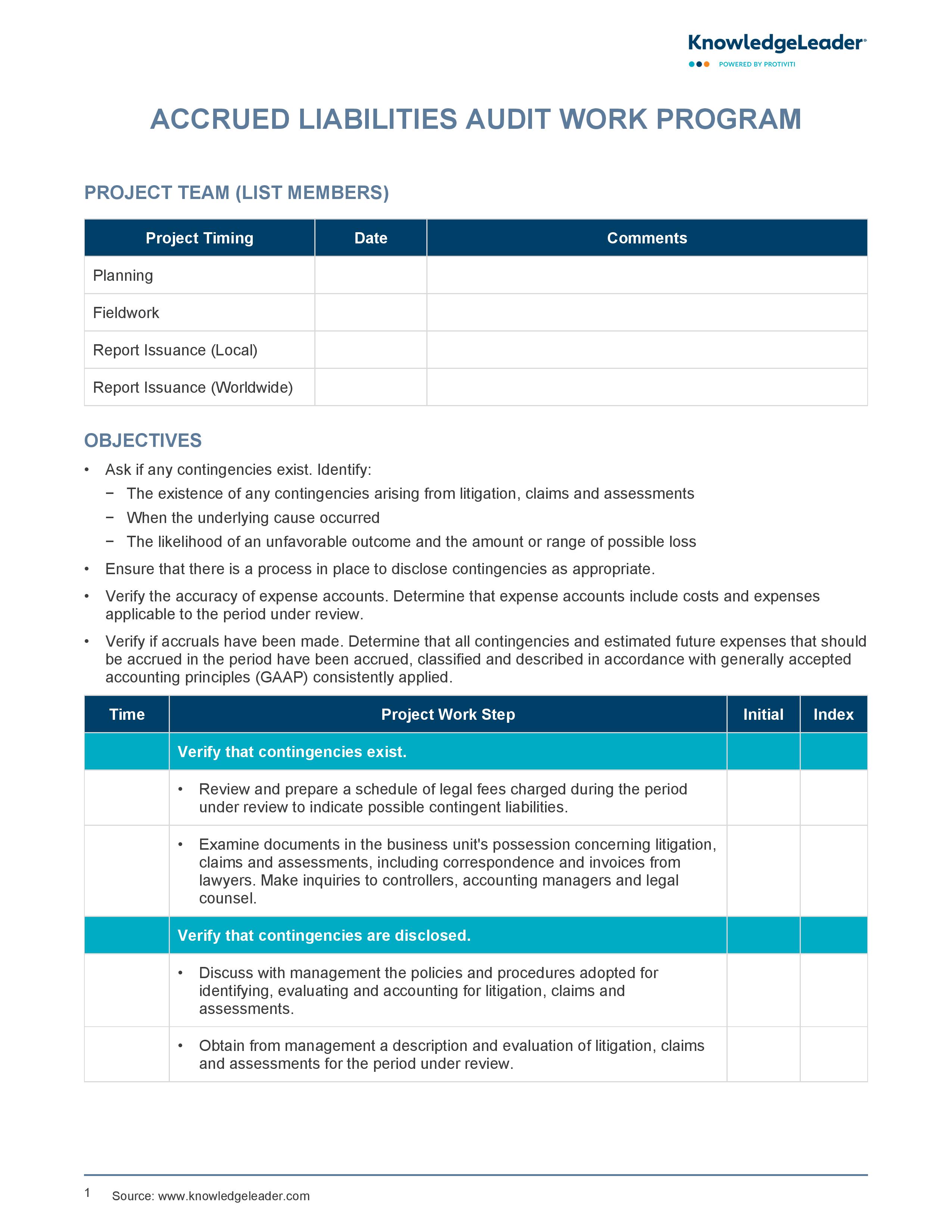

Accrued Liabilities Audit Work Program

Subscriber Content

Preview Image

Image

Accrued Liabilities Audit Best Practices

This sample audit work program primarily focuses on identification and reporting of contingencies and accrued liabilities.

Audit objectives include: ask if any contingencies exist; identify the existence of any contingencies, when the underlying cause occurred, and the likelihood of an unfavorable outcome and the amount or range of possible loss; ensure that there is a process in place to disclose contingencies as appropriate; verify the accuracy of expense accounts; determine that expense accounts include costs and expenses applicable to the period under review; verify if accruals have been made; etc.

Related Resources