Accounts Receivable Reserves Policy

Subscriber Content

Preview Image

Image

Best-Practice Guidelines for Accounts Receivable Reserves

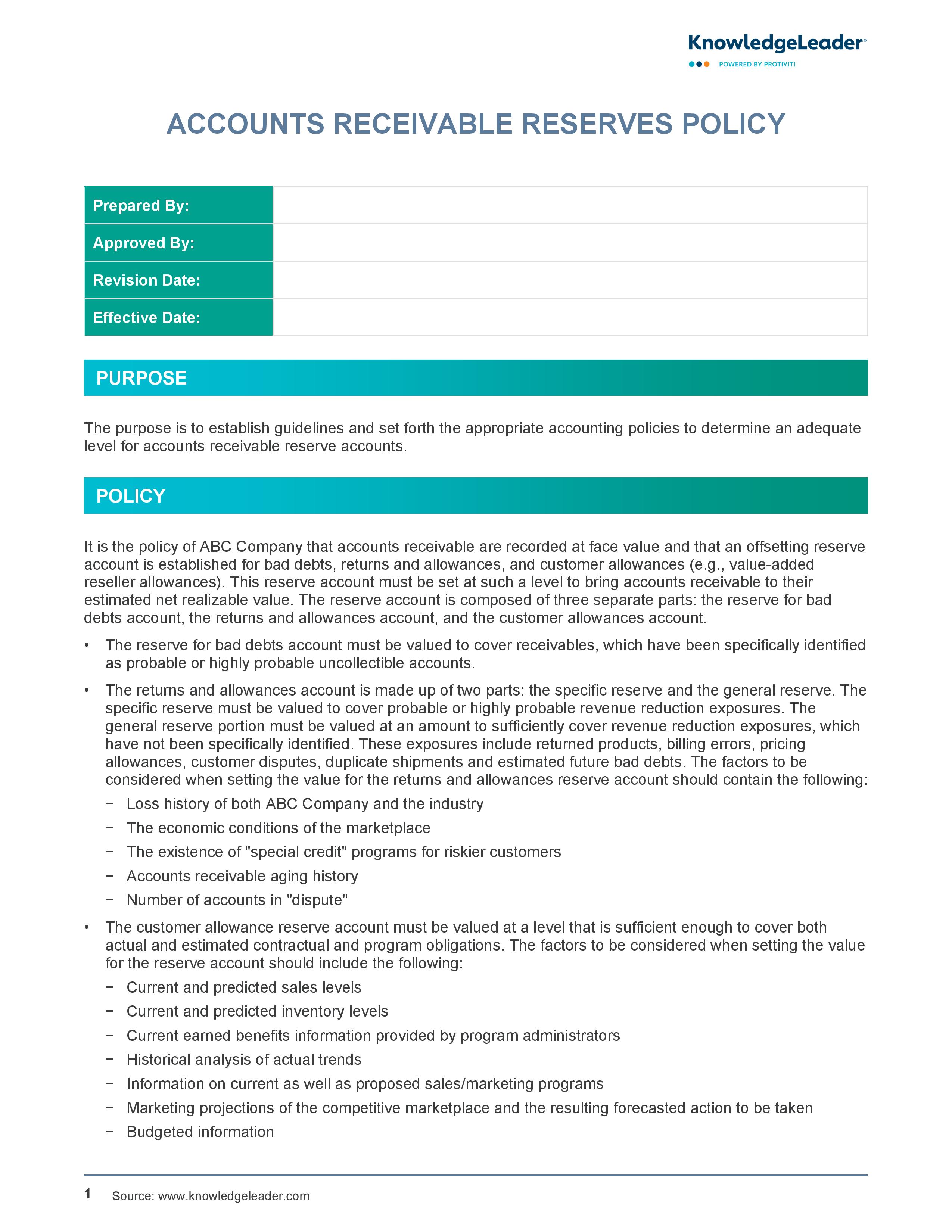

This policy outlines steps for developing an accounts receivable reserve account for bad debts, returns and allowances, and customer allowances.

In this sample, it is the policy of the company that accounts receivable is recorded at face value and that an offsetting reserve account is established for bad debts, returns and allowances, and customer allowances (e.g., value-added reseller allowances). This reserve account must be set at such a level to bring accounts receivable to its estimated net realizable value. The reserve account is composed of three separate parts: the reserve for bad debts account, the returns and allowances account, and the customer allowances account.

Related Resources