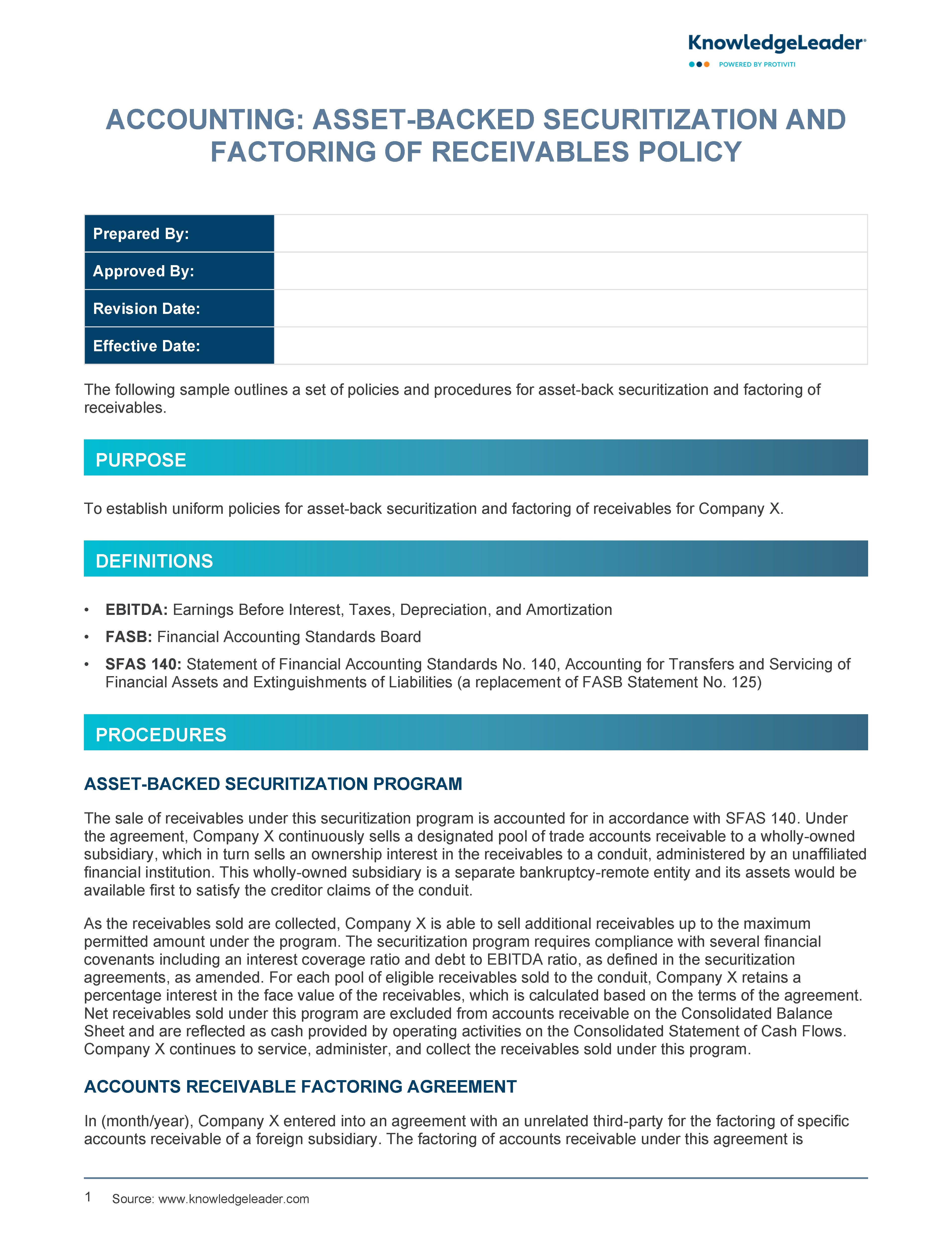

Accounting: Asset-Backed Securitization and Factoring of Receivables Policy

Subscriber Content

Procedures for Managing Asset-Backed Securitization and Receivables Factoring

This policy outlines a set of procedures for asset-backed securitization and factoring of receivables.

In this sample, the sale of receivables under this asset-backed securitization program is accounted for in accordance with SFAS 140. Under the agreement, a company continuously sells a designated pool of trade accounts receivable to a wholly-owned subsidiary, which in turn sells an ownership interest in the receivables to a conduit, administered by an unaffiliated financial institution. Also stated, the factoring of accounts receivable under this agreement is accounted for as a sale in accordance with SFAS 140.

Related Resources