SEC Enforcement Actions Reveal Continuing Importance of Accurate Disclosures

Subscriber Content

Preview Image

Image

Transparency Triumphs: Learning From SEC Enforcement on Accurate Disclosures

In general, regulators frown on types of accounting that massage revenue numbers specifically to conceal poor performance or meet earnings targets. There are a variety of revenue recognition practices that are permissible under generally accepted accounting principles (GAAP) and federal securities laws, provided the policies are disclosed to stakeholders. Without appropriate disclosure, certain accounting practices can mislead investors about a company’s profitability and growth.

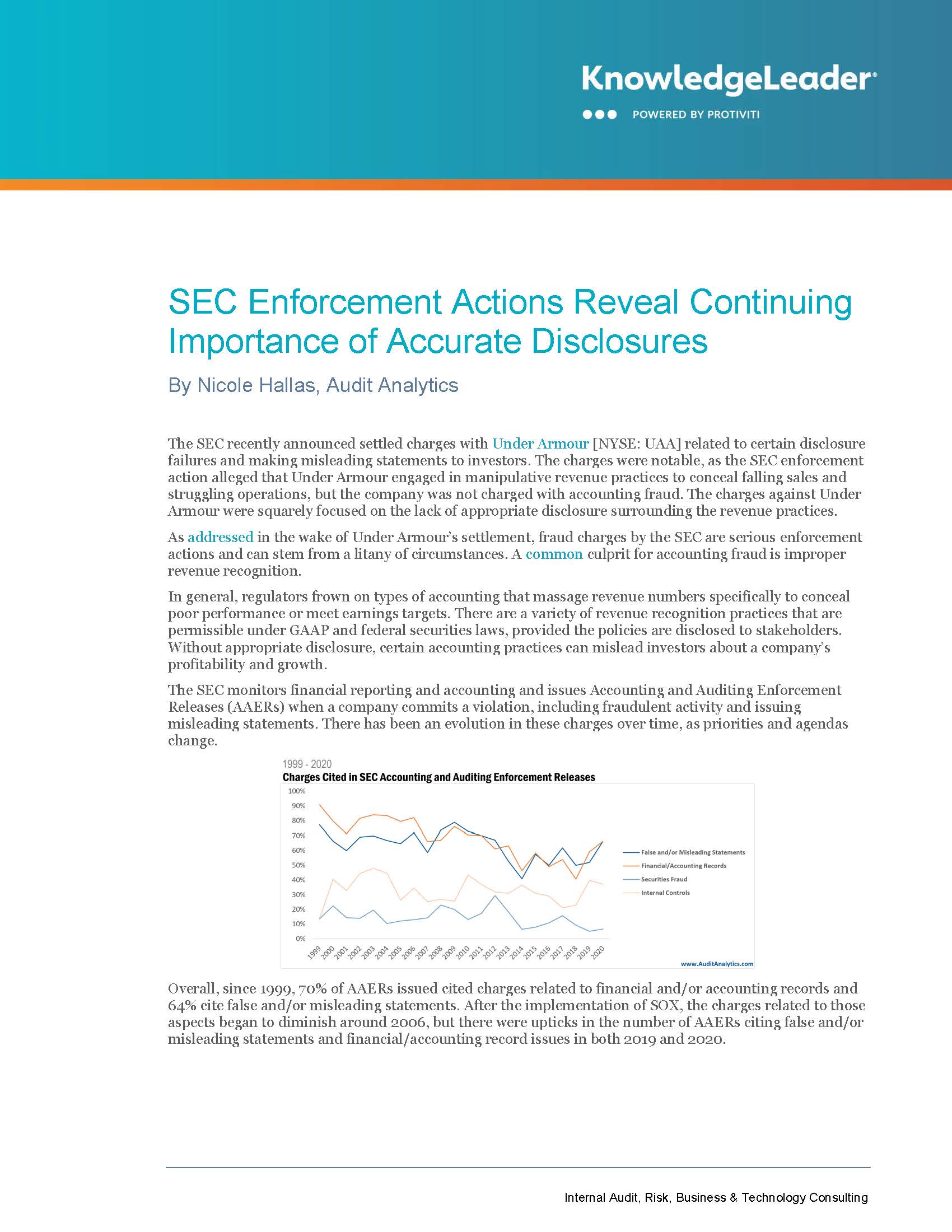

In this article, Audit Analytics examines the recent increase in the amount of enforcement actions citing false and/or misleading statements.

Related Resources